Intel’s second quarter is pretty much a carbon copy of the first three months of 2024 when it comes to revenues across its newly constituted groups, and with an operating loss that is twice as big. And an outlook that basically says it is going to be tough slogging in 2025, with the situation improving as both foundry processes and better chip products hit the market in 2026.

As we exit 2024, there is a non-zero chance that AMD’s official Data Center group will have slightly more revenues than Intel official Data Center and AI group, with both on track to hit somewhere around $12 billion or so. If you add in the edge and datacenter portions of Intel’s Network and Edge group (NEX) as well as the Altera FPGA business, Intel’s “real” datacenter business, as we estimate it, will still be on the order of 25 percent larger than the “real” datacenter business at AMD.

And in 2025, unless current trends do not change, there is no reason to believe that AMD’s datacenter business could not be significantly larger than that of Intel, and this crossover point could happen even earlier if an expected recovery in general purpose server spending does not materialize as expected in the second half of this year.

So when Pat Gelsinger, the prodigal and presumed savior of the company that he loved first and loves best, tells Wall Street that this is the most significant resurrection of Intel since it had to exit the memory business for the first time – we’re not talking about 3D XPoint and flash here, people, but DRAM back in 1985 – he ain’t kidding. This might qualify as a miracle when it is all said and done.

Intel’s numbers for Q2 are bad, to be sure. But the announcement that it was seeking another $10 billion in cost savings, that it would be halting its dividend payments to investors immediately, and that it would be laying off 15 percent of its workforce – it has 116,500 people, plus another 8,800 people in subsidiaries including Mobileye, Altera, and some flash employees that have not been spun out yet to SK Hynix – has sent its stock into a tailspin and its people into panic.

Intel stock is down 26 percent as we go to press. And 15 percent of the core workforce is 17,500 people who are going to get pink slips – and that may not be the end of it, we think. The dividend was already chopped by two thirds earlier this year, so most of this decline in Intel’s market capitalization will be worry about the layoffs and the mad dash to cut the bloat and get leaner and meaner. There is always worry in these situations that the cutting has to go to deep, and it will not just remove fat, but muscle and gouge some bone.

There are going to be some big accounting actions and writeoffs coming as a result of these actions, too, so brace yourself, Wall Street. Intel did not talk about these, but said most of the layoffs will be done by the end of 2024.

Sometimes, such harsh actions work. IBM, which had its self-described “near death experience” back in the mid-1990s, had tens of billions of dollars of writeoffs – just absolutely unheard of, unimaginable, inconceivable for the original blue chip stock – and laid off 200,000 of its 400,000 workforce as it pivoted to software and services and trimmed its independent systems fiefdoms to get its own costs in line with revenues. IBM eventually got back to 400,000 employees, but the way, and has subsequently sold off a lot of systems and services businesses to focus on being a hybrid platform provider, with Red Hat at the center of that strategy. This is IBM’s fifth rebirth in its Herman Hollerith built punch card machines to do the 1890 census in 1890, which is the true kernel of the company we know as Big Blue.

This rebirth of Intel is more like a company reminding itself of what it learned to do in the mid-1980s: design good chips and make good chips, and be paranoid enough to survive. (Andy Grove was right about “only the paranoid survive.”) It is hard to be paranoid, in the right way, when you are filthy rich with very little competition, as Intel was during the 2010s.

And as Nvidia is doing today, Intel had complete hegemony over datacenter compute and dominance over desktop and laptop compute, and it was able to extract and keep most of the profits of the ecosystem built around its compute engines. Let this be a warning: Intel sowed the seeds of its own near-death experience, as companies always do. It is a wise company that lets its partners make some vig out of their enormous efforts to put your products in the field. Jensen Huang’s chanting “Dell, Dell, Dell” back at Computex in May could be a little too little money, a little too little GPU allocations, a little too late.

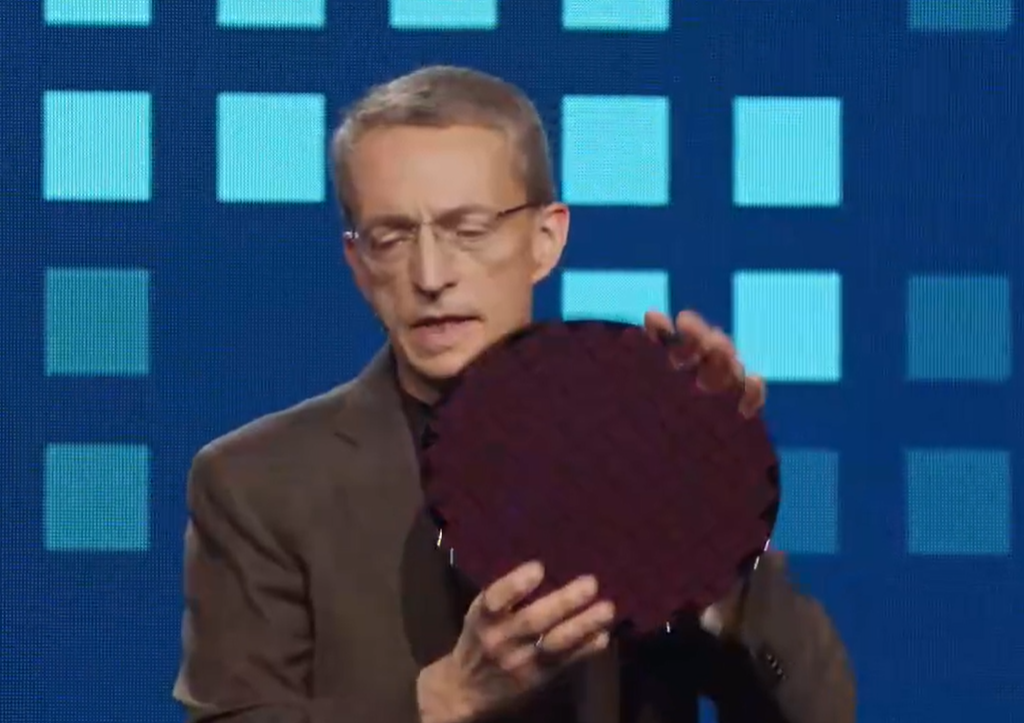

But that is a separate, and parallel, allegory for another day. Intel has even rougher road ahead, but it is, in fact, getting its foundry act together. It is getting its chip designs together and it will be relying less on Taiwan Semiconductor Manufacturing Co for the chiplets in its most advanced CPUs and bring them home to its fabs with its 18A, 14A, and 10A processes. It remains to be seen if others will use its foundry for the 14A and 10A processes, but Intel is clearly getting the third party tooling together from Cadence, Synopsys, Siemens, and Ansys together so they can, and we think it will get some business from chip makers looking for alternative etching and packaging. We think it will have a profitable foundry operation and that it will make good chips that people want to buy as well. But we also think the X86 market is going to decline as Arm rises at the hyperscale and cloud builders, and Intel not only knows this, but accepted this years ago and that is why it must have an open foundry business. If you can’t beat Arm CPUs, you have to make Arm CPUs.

“We firmly believe in the IDM 2.0 strategy,” Gelsinger told analysts on the call with Wall Street. “We are building two world-class companies. The forensics that we have done this year – this clean sheet exercise as we could describe it – is building a world-class Intel Foundry and building a world-class Intel Products Group. These efforts, we believe, have identified many opportunities for us to have financial savings. We have launched those aggressive steps today, and we believe that with the new products, a better financial position that we have done for a more efficient operation, that we see the long-term opportunity for significant value creation for all of our stakeholders.”

That is a lot calmer than the situation really is. This is going to be hard to watch over the next couple of years, and even harder to do. We want Intel to succeed, and we have faith that the IT sector will be better when it does. For whatever that is worth.

With that, let’s go through the numbers for the second quarter. Intel rejiggered its financial reporting starting this year, and this is what it looks like now with Q2 added into he mix:

In the second quarter, Intel had $12.83 billion in revenues, down nine-tenths of a point, and posted an operating loss of $1.96 billion, almost twice that from the year ago period and from the first quarter of 2021. Because it has subsidiaries and so many intersegment eliminations, we are only getting an operating income from Intel these days, not a net income.

Intel exited the quarter with $11.3 billion in cash and just a tad under $18 billion in short term investments. Which is enough capital for maybe one and a half fabs these days. In other words, not much if you are trying to be the world’s second largest foundry and compete against TSMC.

If the US government hadn’t given Intel $8.5 billion in cash and incentives as part of the CHIPS Act and if it had not been able to get Apollo Global Management to invest in its Ireland fabs and Brookfield Asset Management to invest in its Arizona fabs, the company would have had to burn that investment fund for cash. And, given where Intel may be going, the company may have to do that anyway.

The DCAI group saw sales decline by 3.5 percent to $3.05 billion, and operating profit was hit by a 41.2 percent decline to $276 million, which represents a mere 9.1 percent of revenues.

Remember when Intel’s datacenter business was consistently delivering operating income above 45 percent of revenues, and often kissed 50 percent? Remember when it was around $7 billion a quarter?

The NEX group had a 1.5 percent decline in Q2 to $1.34 billion, but operating income more than doubled to $139 million. Both DCAI and NEX are dealing with the fact that Intel’s OEM and ODM customers bought a lot of chippery in 2022 and 2023 and they have to burn down inventory. Intel still believes a server recovery is underway in the second half outside of AI servers, and that it still has an advantage as the host processor for AI servers. We shall see.

For the past decade, we have been trying to extract the “real” Intel datacenter business out of its numbers, which was a bit harder when Intel had flash, 3D XPoint memory, various kinds of networking, custom systems, and edge server and telco server stuff spread across various divisions. It is getting easier to figure this, but it is not fun to do so, as you can see in the chart above.

By our estimating, this real Intel datacenter business is down 11.8 percent to $4.62 billion, and flat sequentially from Q1, and operating income is down 55.6 percent to $390 million, representing an 8.4 percent share of revenues.

While the existing Xeon 6 “Sierra Forest” and forthcoming “Granite Rapids” server CPUs will help, AMD has its “Turin” Zen 5 Epyc server CPUs right around the corner, and all the hyperscalers and cloud builders have or will have custom Arm server CPUs. The pie is just not as big for Intel as it used to be – and never will be again.